The RBI recently cut the repo rate by 25 basis points, marking the first reduction in five years. Following this, the country's largest bank, SBI, has

The RBI recently cut the repo rate by 25 basis points, marking the first reduction in five years. Following this, the country’s largest bank, SBI, has also lowered interest rates on some of its loans. The bank has reduced rates on various new retail and business loans, which are linked to the External Benchmark Rate (EBR).

As a result, getting a home loan has become easier. Currently, the home loan linked to EBR is 8.9%, which includes the RBI’s repo rate of 6.25% and a spread of 2.65%. Now, home loans will be available at rates between 8.25% and 9.2%, depending on the borrower’s credit score.

Home Loan Maxgain (Overdraft) Option

The Home Loan Maxgain (Overdraft) option is available with interest rates ranging from 8.45% to 9.4%. Top-up loans are offered at rates from 8.55% to 11.05%, while top-up (overdraft) loans range from 8.75% to 9.7%. Loans against property are available with rates between 9.75% and 11.05%. The reverse mortgage loan for senior citizens is fixed at 11.3%. The YONO Insta Home Top-up Loan is being offered at 9.1%.

Interest Rates Depend on Your CIBIL Score

Interest rates vary depending on your credit score. Business loans, which are linked to the Marginal Cost of Funds (MCLR), will only decrease if the deposit interest rates are reduced. It is important to note that last week, HDFC Bank raised its MCLR despite the RBI rate cut.

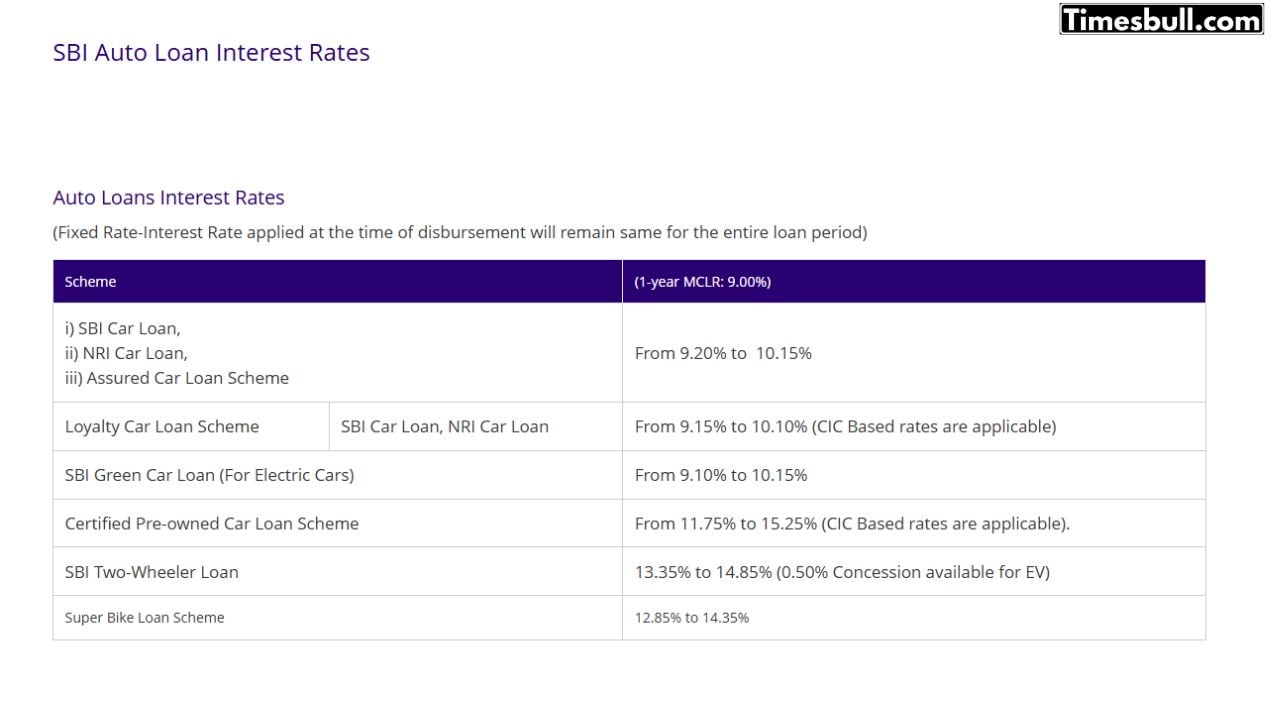

Auto Loan

SBI’s auto loans are linked to the one-year MCLR, which is currently 9%. These rates will decrease only when the deposit costs are reduced. For Standard Car Loans, SBI Car Loans, NRI Car Loans, and Assured Car Loan Schemes, the interest rates range from 9.2% to 10.15%. Loyalty Car Loan Schemes come with slightly lower rates, ranging from 9.15% to 10.1%, depending on your credit profile.

SBI Green Car Loan

The SBI Green Car Loan for electric vehicles is available with interest rates ranging from 9.1% to 10.15%. Additionally, two-wheeler loans range from 13.35% to 14.85%, with a 0.5% discount for electric vehicles.